Corporation Tax

Enable your team to produce tax computations and CT600s faster with automation and integration.

Request a demo

Fast, easy Corporation Tax software

Filing tax has accelerated past the days of paper submissions – the future of tax is digital. Thrive in the digital world and efficiently manage your tax process with Caseware Corporation Tax.

Leverage capability and integration and automate the process of producing corporation tax computations and filing CT600. Enhance your efficiency at every stage of your tax process and calculate, analyse, produce, tag and submit online in one easy process.

Features

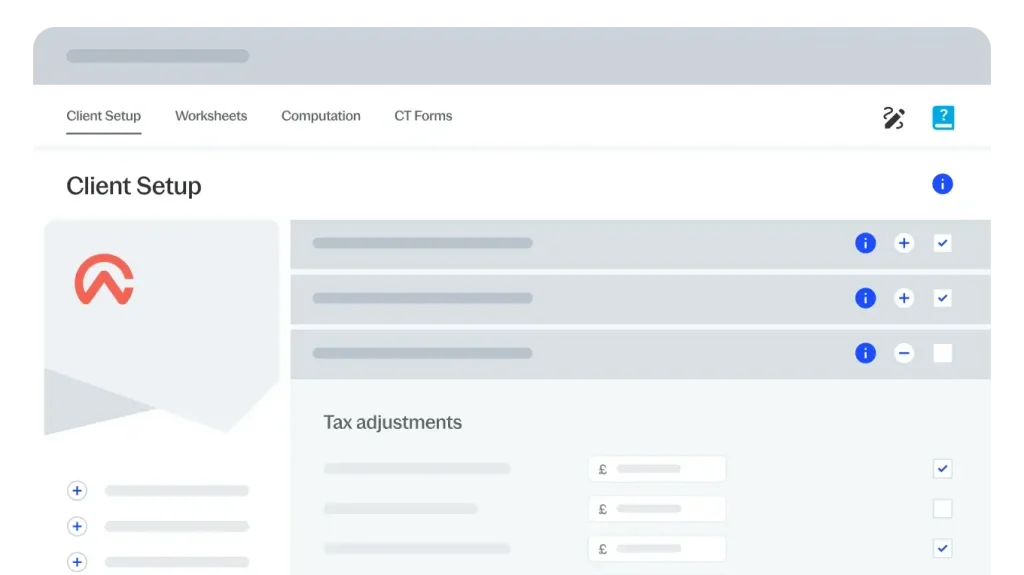

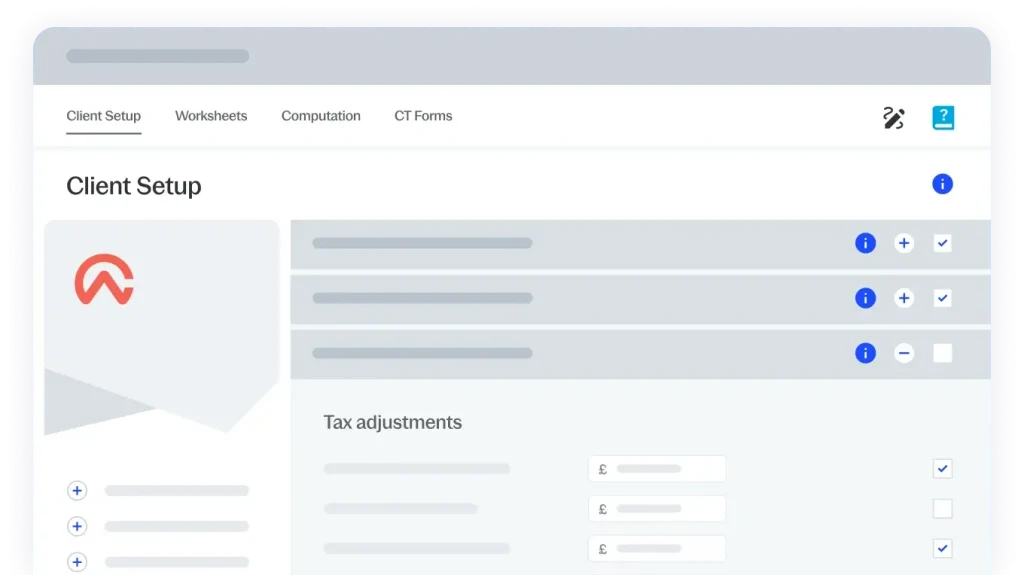

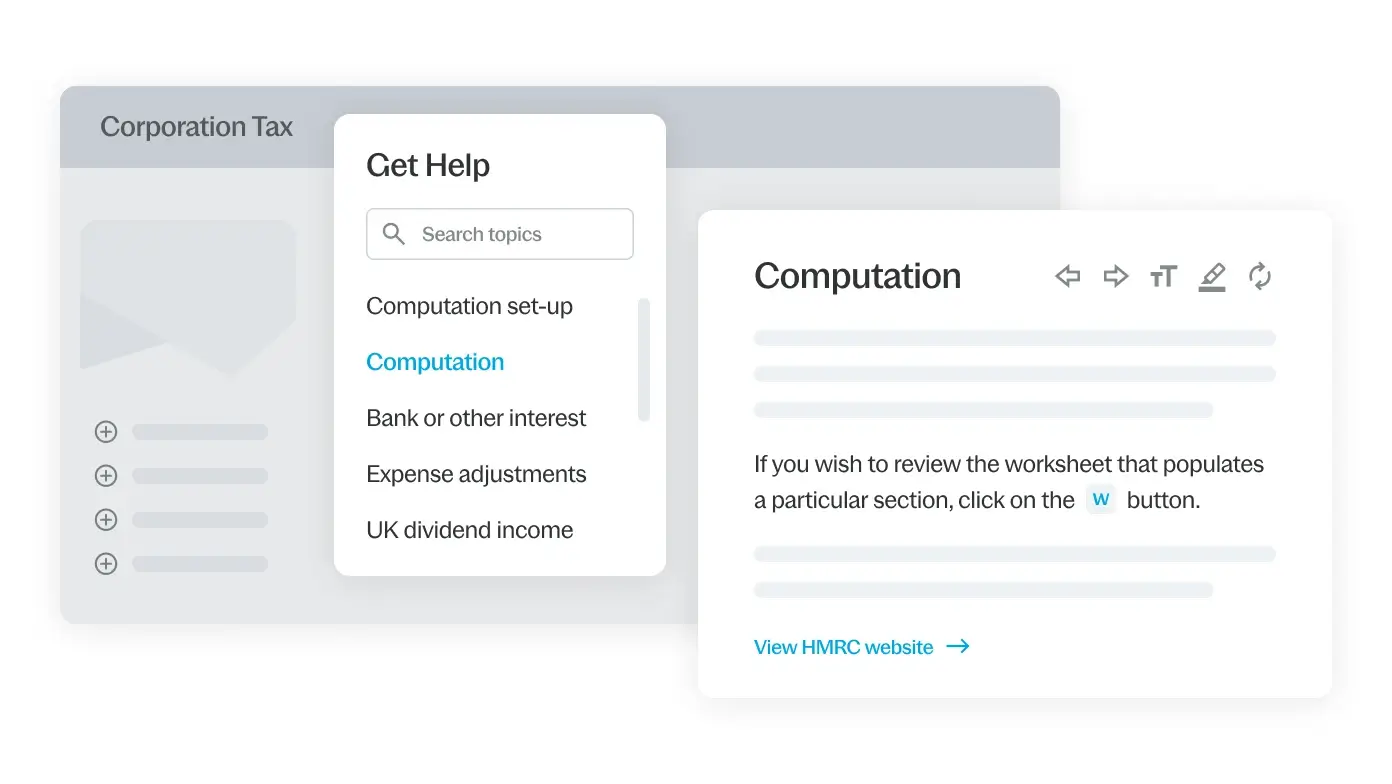

Integrated step by step guidance that increases accuracy and efficiency

Be up and running in minutes and use the built-in wizard with logical, easy-to-follow workflows enabling you to guarantee computations quickly, then check, analyse and adjust as necessary.

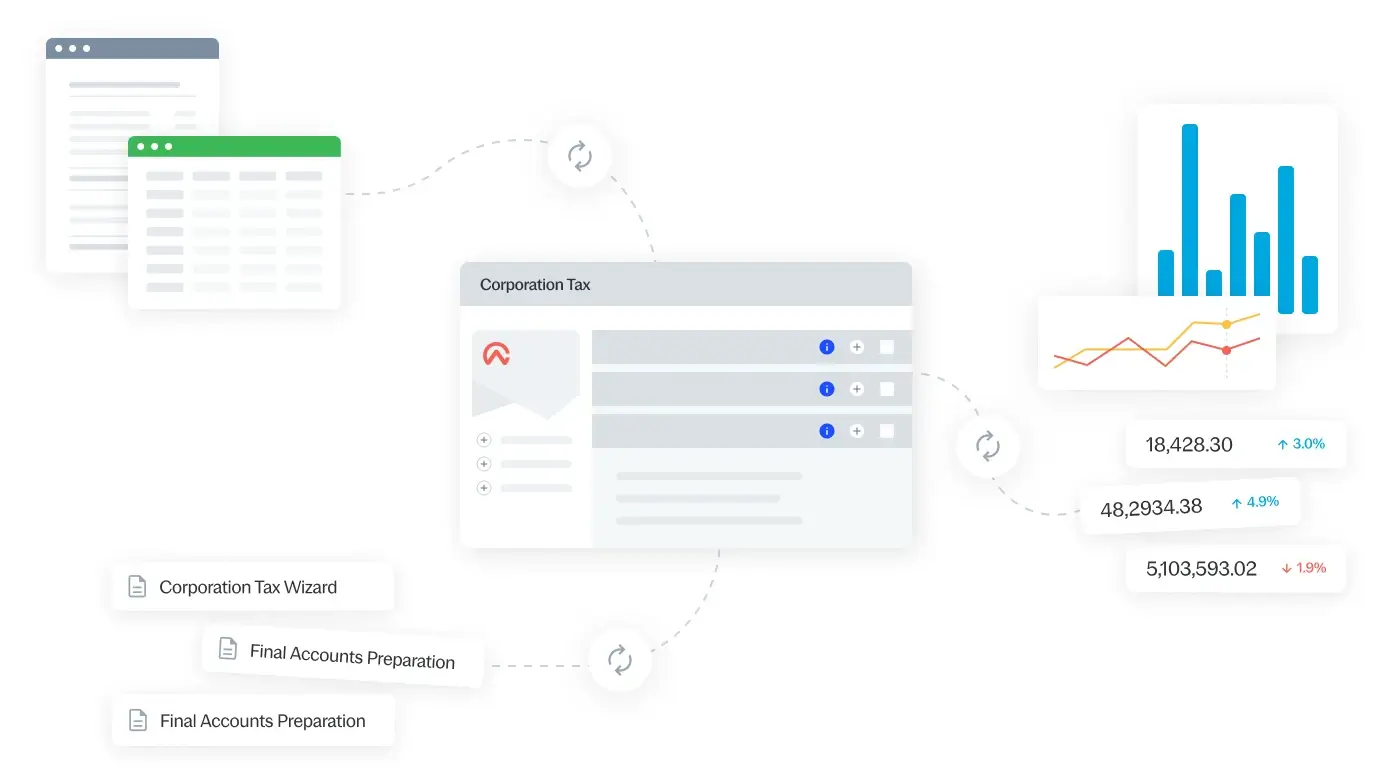

Full integration enables you to see the picture clearly

Our software works perfectly as a standalone product, but also integrates fully with our suite of products. Offering full integration saves you time by pre-populating fields for you and eliminates the need to import or export data from other sources.

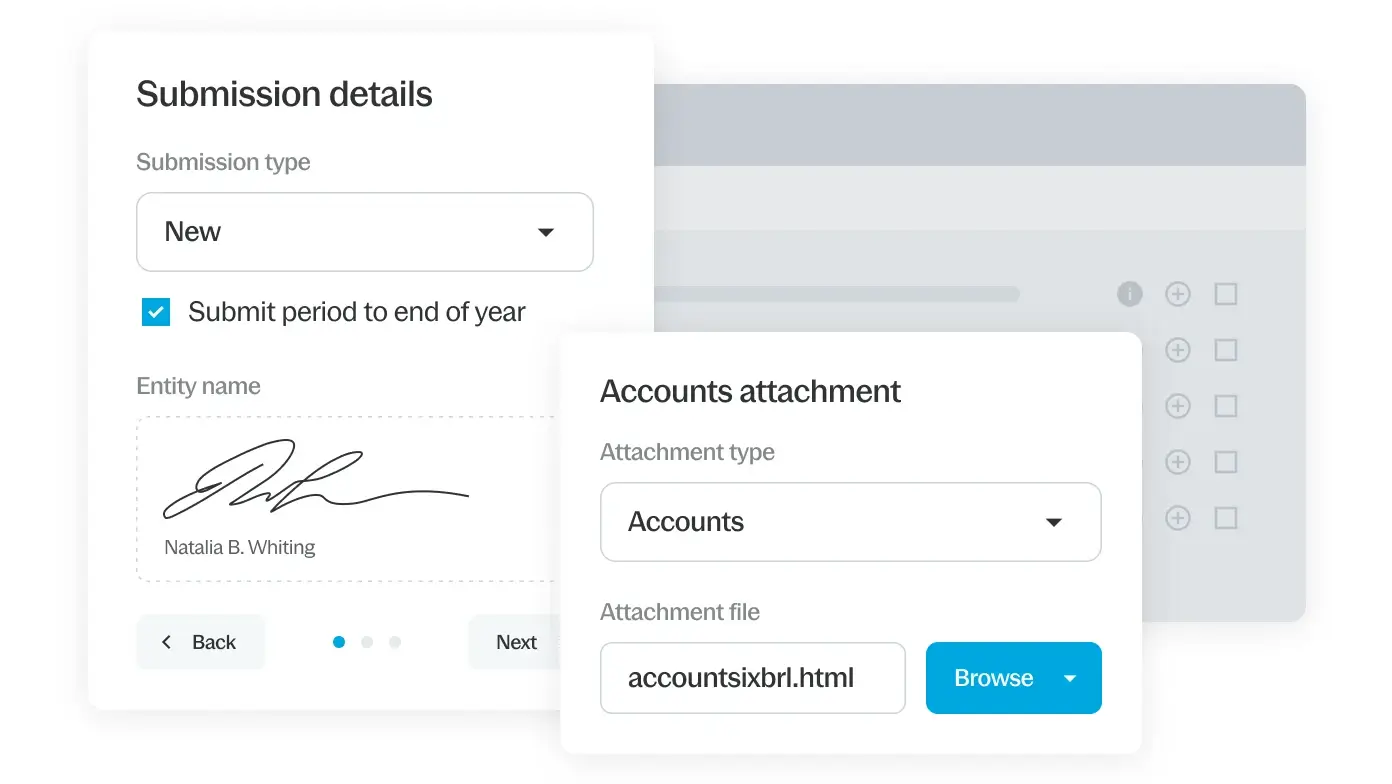

Direct submissions to HMRC all in one place, through Caseware Cloud

Incorporating all the latest taxonomies and revised CT600 forms, our solution allows you to quickly and easily complete and submit an unlimited amount of tax returns directly to HMRC online.

Benefits

Comply with confidence

Work together – from anywhere

Ensure consistency and efficiency

Supporting tools

Easy-to-use templates that simplifies accounting processes

Take advantage of carefully crafted templates developed by leading standards bodies designed to simplify the lives of finance professionals.

-

Working Papers

arrow_forwardWork smarter and faster by improving audit and accounting engagement workflows with Caseware Working Papers.

-

Accounts Production

arrow_forwardIncrease efficiency within your practice by up to 50% with our accounts production software. Allowing accountants to produce fully compliant financial statements across a wide range of entity types, regardless of how complex your accounting structure may be.

-

Caseware IDEA

arrow_forwardCaseware IDEA data analysis software seamlessly integrates with Caseware Working Papers and Caseware Cloud to offer a one-stop, easy-to-use solution for external auditors, accountants and data analysts.

Modules to help financial professionals be more efficient

Enhance platform capabilities with our intelligent tools

-

SmartSync

arrow_forwardProvide everyone on your team with up-to-date changes to working papers, eliminating the need to manage synchronisation. Team members collaborate on local copies of a client file in real time, with each automated Working Papers file syncing in the background.

-

CloudBridge

arrow_forwardSeamlessly transfer data from Caseware Working Papers to a cloud engagement. To import data to a cloud engagement, begin by downloading the installation package and install the version of CloudBridge for your region.